Purchasing a home can be an overwhelming and nerve-wracking process, especially for first-time homebuyers. The procedure can be too complicated, and there are numerous factors to consider before making the right decision. However, with the right information and advice, you can make the home buying process less stressful and challenging. In this article, we’ll provide you with 4 top tips for first-time home buyers to aid you in becoming a successful homeowner. Read on to get started!

Tip 1: Get Pre-Approved for A Mortgage

One of the first things you should do as a first-time home buyer is to get pre-approved for a mortgage. Pre-approval will provide you with an estimate of how much you can borrow for your home, how much your payments will be, and what interest rate you qualify for. This will help you determine your budget and make the home buying process more manageable.

Tip 2: Research the Neighborhood

Researching the neighborhood is one of the most important steps in the home buying process. Check out amenities, crime rates, school districts, and public transportation availability. Understanding the area will help you decide if it’s a good fit for your lifestyle and if the home price is reasonable for the neighborhood.

Tip 3: Choose the Right Real Estate Agent

Select the right real estate agent. Your agent should be able to understand your needs, be familiar with the area you want to buy, and have a list of properties that suit you. This will help you make informed choices throughout the process and ensure that the transaction runs smoothly.

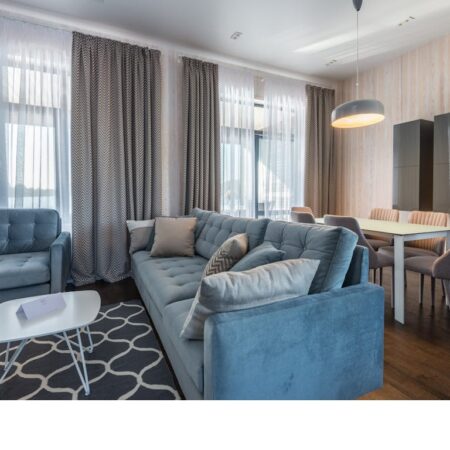

Tip 4: Inspect the Property Before Purchasing

Make sure you inspect the property thoroughly before closing the deal. Look out for cracks, leaks, or other significant defects that can be deal-breakers. Have a property inspector check the house to ensure that you know the possible repair costs.

In conclusion, purchasing a home can be a daunting process, but these tips can help you have a more manageable experience. Get pre-approved for a mortgage, research the neighborhood, choose a reliable agent, and inspect the property. Also, don’t forget to shop around. With a little planning and preparation, you can buy the home of your dreams and build your own wealth.